FICO® Score Credit Education

Your go-to resources for all things related to understanding and improving your FICO® Score.

What is a FICO® Score?

FICO® Scores are the most widely used credit scores. Each FICO® Score is a three-digit number calculated from the data on your credit reports at the three major consumer reporting agencies-Experian, TransUnion, and Equifax.

Your FICO® Scores predict how likely you are to pay back a credit obligation as agreed. Lenders use FICO® Scores to help them quickly, consistently, and objectively evaluate potential borrowers' credit risk.

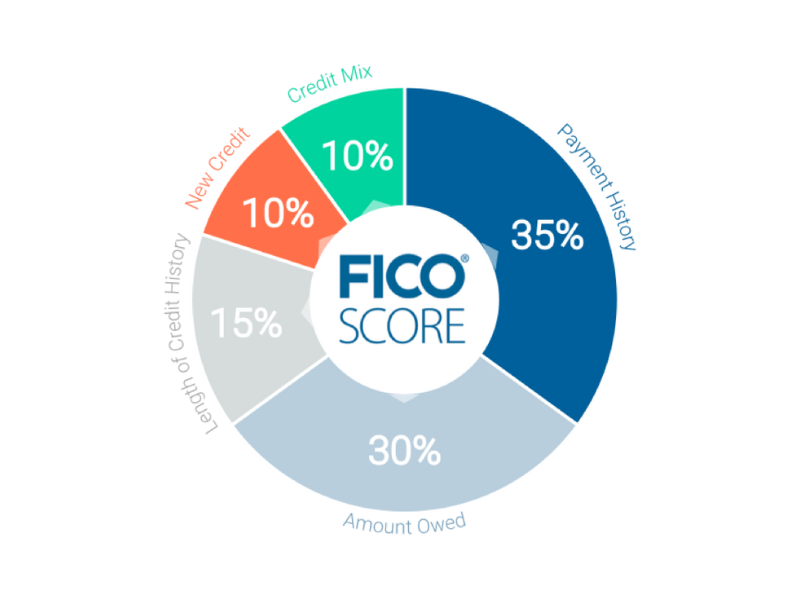

How FICO® Scores are calculated

- 35% - Payment history. Whether you've paid past credit accounts on time.

- 30% - Amounts owed. Amount of credit and loans you are using.

- 15% - Length of credit history. How long you've had credit.

- 10% - New credit. Frequency of credit inquires and new account openings.

- 10% - Credit mix. Mix of your credit, retail accounts, installment loans, finance company accounts and mortgage loans.

What is a good FICO® Score?

FICO® Scores generally range from 300 to 850, where higher scores demonstrate lower credit risk, and lower scores demonstrate higher credit risk (note: some types of FICO® Scores have a slightly broader range). What's considered a "good" FICO® Score varies, since each lender has its own standards for approving credit applications, based on the level of risk it finds acceptable. So, one lender may offer its lowest interest rates to people with FICO® Scores above 730, while another may only offer it to people with FICO® Scores above 760.

The chart below provides a breakdown of ranges for FICO® Scores found across the U.S. consumer population. Again, each lender has its own credit risk standards, but this chart can serve as a general guide of what a FICO® Score represents.

Credit Education Videos

FICO® Scores FAQs

-

Why are you providing FICO® Scores?

Nearly all lenders in the U.S., including The Police Credit Union, use FICO® Scores, as the industry standard for determining credit worthiness. Reviewing your FICO® Scores can help you learn how lenders view your credit risk and allow you to better understand your financial health.

-

What are score factors?

Score factors are delivered with a consumer's FICO® Score, these are the top areas that affected that consumer's FICO® Scores. The order in which the score factors are listed is important. The first factor indicates the area that most affected the score, and the second factor is the next most significant influence. Addressing these factors can benefit the score.

-

Why is my FICO® Score different than other scores I've seen?

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO® Scores are based on credit file data from a consumer reporting agency, so differences in your credit files may create differences in your FICO® Scores.

-

Why do FICO® Scores fluctuate/change?

There are many reasons why a score may change. FICO® Scores are calculated each time they are requested, taking into consideration the information that is in your credit file from a consumer reporting agency at that time. So, as the information in your credit file at that CRA changes, FICO® Scores can also change. Review your key score factors, which explain what factors from your credit report most affected a score. Comparing key score factors from the two different time periods can help identify causes for a change in a FICO® Score. Keep in mind that certain events such as late payments or bankruptcy can lower FICO® Scores quickly.

-

How do I see my FICO® Score in Digital Banking?

You'll need to opt in before you can see your score:

- Click on Account Services in the navigation menu.

- Click on See My FICO® Score.

- Follow the link on screen to opt in and view your FICO® Score.

- Review the agreement, then check the box and press the Opt In button.

- You may opt out at any time.

Visit our Digital Banking Help page for more information.

-

Will receiving my FICO® Score impact my credit?

No. The FICO® Score we provide to you will not impact your credit.

-

How do I check my credit report for free?

You may get a free copy of your credit report from each of the three major consumer reporting agencies annually. To request a copy of your credit report, please visit: www.annualcreditreport.com. Please note that your free credit report will not include your FICO® Score. Because your FICO® Score is based on the information in your credit report, it is important to make sure that the credit report information is accurate.

We're Here to Help

Other ways to connect with us

Call us at 800.222.1391 or find a branch location, by clicking the button below.

Our LocationsMeet with us virtually

Schedule an appointment or meet a member of our Virtual Branch team from your computer, laptop, or mobile device

Visit our Virtual BranchVirtual Branch Hours

Monday - Friday: 10:00 a.m. - 5:00 p.m. PST

Saturday: 9:00 a.m. - 12:00 p.m., 12:30 p.m. - 3:00 p.m. PST

External Link Alert

You are leaving our website and linking to an alternative website not operated by us. The Credit Union does not endorse or guarantee the products, information, or recommendations provided by third-party vendors or third-party linked sites.

The Credit Union is not liable for any failure of products or services advertised on those sites. Each third-party site may have a privacy policy different than the Credit Union; and the linked third-party website may provide less security than the Credit Union's website. If you click "OK", an external website that is owned and operated by a third-party will be opened in a new browser window. If you click "CANCEL" you will be returned to our website.